Now that summer is coming to a close, and class will soon be back in session for thousands of students across the country, many parents and students will be looking for a new set of wheels for back to school.

Purchasing a first vehicle is a major milestone and a major investment. With so many options available, the process of choosing the right car can be daunting. So we’ve done some legwork, and though vehicle preferences can be very subjective, we’ve lined up some good options at various price points – both new and used – to help those looking for some good recommendations.

Set a budget

Buying a first car can be a fun and thrilling experience. But it can also be easy to get swept up in the excitement and end up spending outside your means. So it’s important to establish a realistic budget before you start looking at any vehicles. If parents or partners (or anyone else) will be involved in purchasing the vehicle, have an open discussion with them on this budget, and use these parameters to guide your search.

In addition to the cost of the vehicle, remember to factor in additional costs such as insurance, gas, maintenance, etc.

What’s important to you?

It’s important to consider how you or your child will use the vehicle, because that will impact the type of vehicle you end up selecting. Will the car be used for light city driving, or occasional errands on the weekends? Will there be long-distance driving involved, and will they need extra cargo space to move into their dorm?

Together as a family, make a list of “must haves” and “nice to haves”. It’s important to understand which features you could give up if the budget requires, and which you can’t live without.

Safety features are always an important priority to keep in mind, even if not as glamorous as some others. Newer models generally offer more safety features, sometimes even in the standard model.

Do your research

Once you’ve narrowed down a list of must-have features, do your homework and dedicate some time to reading/watching reviews on different car models, and getting an understanding of the pricing of your vehicle by consulting sites like this one. The more prepared you are, the more confident you’ll feel once you meet with sellers or dealers to make a well-informed decision.

Make sure you also do some research so you truly understand what the vehicle ownership experience will be like. How much it will cost to insure, what the regular maintenance lookw like, and whether it requires premium or regular fuel are all good to know before you buy.

New or used?

Now that you have an idea of what you’re looking for, it’s time for the age-old question – should you buy new or used?

New

New cars can often be an “easy” entry into car ownership. You walk into a dealership, tell them what you want, which options you’re looking for, and they bring it around for you.

And there are lots of benefits of buying new: predictable monthly payments with traditionally lower interest rate than used, repairs covered under warranty (with roadside assistance usually included), the latest technology, added safety features, higher fuel efficiency, and of course, that new car smell.

The downside, of course, is the higher cost. New vehicles come with a higher overall price tag, and quicker depreciation.

Used

A great alternative to buying new is used. There’s more variety because you’re not just dealing with the newest models, and buying used usually leads to bigger savings. You get most of the car’s life, and some or most of the warranty for a fraction of the new-car price. Plus you can avoid new-car fees, there’s more choice among age, make, model, and trim, and insurance rates tend to be lower.

The downside here is the uncertainty over the mechanical condition of a previously used vehicle, which generally requires more maintenance and repairs, and often don’t have all the latest safety, fuel efficiency, or convenience features.

Leasing or financing?

Once you’ve found the perfect car, it’s time to figure out a payment plan: should you lease or should you finance? Both have their pros and cons. Traditionally, this has been a decision mainly for new vehicle buyers, but more and more companies (usually luxury makes) are offering leases on certified pre-owned (CPO) vehicles, which can be a very appealing option.

It’s important to weigh factors such as typical mileage – are you or your student commuting long distances to school every day, or are they travelling only short distances? How long do you plan on keeping the vehicle?

Leasing

Leases are better for folks who don’t drive more than average (roughly 20,000 km per year), who don’t want a long-term commitment to a vehicle and tend to want the latest features. Leasing also allows for largely predictable monthly budgeting, though some repair or maintenance costs may still be involved.

Leasing is essentially a long-term rental unless you choose to buy out the vehicle at the end of the lease. You are therefore responsible for excessive mileage and any damage that may occur.

Financial experts will generally tell you that ideally you want to rent depreciating assets (pretty much every vehicle), and buy ones that appreciate. But some folks just don’t like the idea of having ongoing car payments that don’t end.

Financing

Financing does have it advantages too: payment lengths can be more flexible, interest rates are often lower than with used cars or leasing, and manufacturer rebates are sometimes higher than lease deals. In the end, the major savings generally come when you can combine years of payment-free use with low maintenance and repair bills.

On the downside, the fact that the vehicle will be paid off in full by the end of the borrowing term means that financing payments will generally be higher than lease rates. And if you try to stretch out payments over many years to make monthly finance payments lower, keep in mind your total interest owed, as it could add up.

It’s very possible that a vehicle could depreciate faster than it is paid off, meaning you could still owe money on it if the car is wrecked in a collision, or when you try to trade it in on another vehicle.

Our Back-to-School Picks

Okay, so let’s talk specifics now. We’ve collected a variety of vehicles below, recommended based on various buyer priorities and price ranges. It’s important when looking at used vehicles to also look for evidence of regular maintenance and for any mechanical issues, and we have a whole section of Used Car Reviews that go into more detail about what to look out for in specific vehicles. But this list will provide a good variety of vehicles for many different buyers or parents of potential first-vehicle owners.

Affordable Used Cars ($5,000–$10,000)

Safety

2004–2008 Volvo S60: Still the best safety for your buck.

Utility

2009 Dodge Ram: Some Rams from two generations ago are now showing up in this price range. Hard to beat a truck for practicality – except maybe a minivan.

Reliability

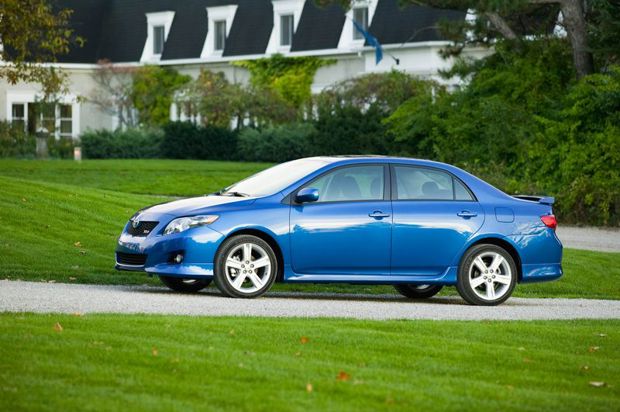

2008–2010 Toyota Corolla: There’s a reason there are so many million-kilometre Corolla stories around.

Fuel Economy

2009–2010 Honda Fit: Still the king in this price bracket for cheap running, and good utility too.

Driving Enjoyment

2008–2010 Mini Cooper: Be wary of mechanical gremlins on low-low-price ones, but so much fun to drive, and stylish to boot.

Affordable New Cars ($12,000+)

Affordability

Nissan Micra: Canada’s most affordable car, starting right around $10K for a barebones model before taxes and fees, but also adorable and so fun.

Modern Tech

Ford, GM, Hyundai, Kia, VW: All have Android Auto and Apple CarPlay standard at low price points. GM and Ford especially have good charging points and Wi-Fi hotspots.

Safety

Toyota Corolla: For its standard suite of useful safety features.

Fuel Economy

Hyundai Ioniq Hybrid: Best real-world fuel economy in a regular hybrid I’ve experienced.

Affordable Driving Enjoyment

Ford Fiesta ST: So much fun to toss around.

Luxury

Upcoming Mercedes-Benz A-Class or GLA: For “my first Mercedes-Benz” experience.