autoTRADER.ca continues to closely monitor Canadian car pricing trends month-over-month and year-over-year, leveraging robust data from over 450,000 new and used vehicle listings on our marketplace. Between October 26 and November 25, 2020, national median new and used vehicle listing data indicated another period of pricing increases, driven by growing consumer demand and inventory shortages. The ongoing supply and demand mismatch is keeping prices buoyant during a typically slower season for car buying, resulting in moderate month-over-month pricing increases and more notable year-over-year increases for used vehicles.

Trucks are leading the growth curve again in November, experiencing the strongest year-over-year increases, compared to alternate body types like sedans and SUVs. We expect developments related to the global pandemic to further influence market conditions and the trajectory of Canadian vehicle prices for the remainder of 2020 and leading into the new year. We will continue to monitor pricing behaviour and report our findings in next month’s Price Index.

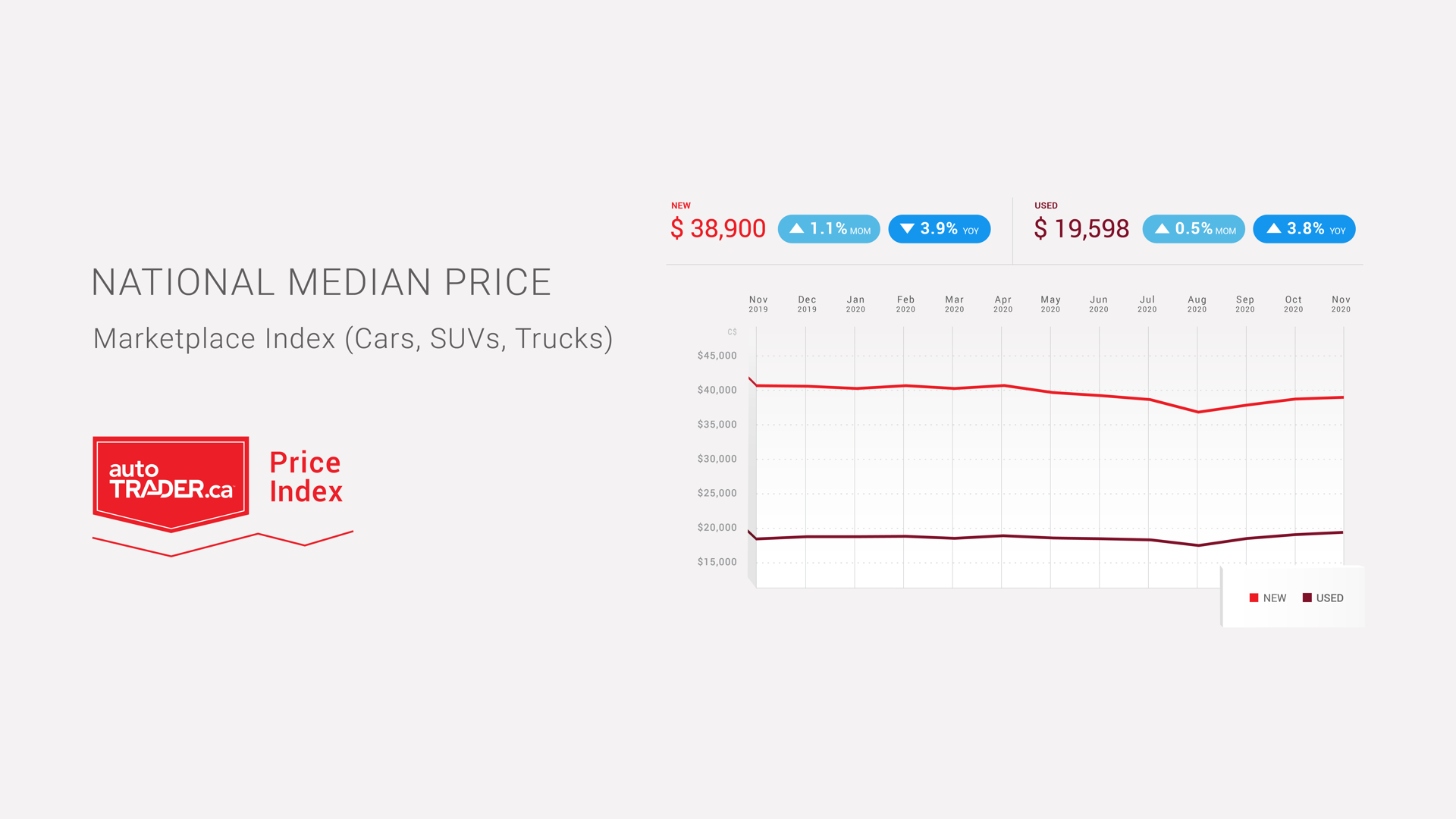

National median new and used vehicle prices increase month-over-month

The median retail price of a new vehicle across Canada settled at $38,900, representing an increase of 1.1 per cent month-over-month and a decrease of 3.9 per cent year-over-year. Meanwhile, the median price of a used vehicle closed the month at $19,598, marking a 0.5 per cent increase month-over-month. Used car prices experienced a year-over-year increase for a second consecutive month at 3.8 per cent, hinting that the market trajectory is slowly moving towards aligning with historical patterns.

New and used truck prices experience the largest year-over-year increase

When examining vehicle pricing by body type, new truck prices saw another month of increases at 0.8 per cent month-over-month and 9.6 per cent year-over-year ($60,297). This is likely due to the sustained demand for trucks across the country met with a shortage of supply caused by manufacturing delays. New sedan prices also experienced a 0.3 per cent increase month-over-month and 5.5 per cent increase year-over-year at $29,355, continuing the upward trend reported last month. SUV prices increased 1.5 per cent month-over-month and 3.3 per cent year-over-year finishing at $38,722. This is indicative of the overall increase in consumer demand for SUVs, especially sub-compact and compact SUVs, coupled with reduced inventory availability in the market.

Used trucks experienced the largest year-over-year increase to date in 2020, clocking a double-digit upsurge of 16.7 percent. This further highlights the impact the lack of new truck inventory has on driving up prices for used trucks. Used sedan prices remained flat month-over-month, closing at $15,995, while used SUVs experienced the highest month-over-month increase across body types at 1.8 per cent, settling the month at $22,900. Both used sedans and SUVs experienced growth year-over-year at 6.7 and 1.8 per cent respectively.

European new vehicle prices record highest year-over-year growth

Analyzing prices by manufacturer of origin, both new and used vehicles experienced pricing increases for the most part. European new vehicles saw their strongest year-over-year increase of 2020 at 7.9 per cent ($54,439), almost doubling last month’s performance. Month-over-month, European new vehicles experienced an increase of 2.5 per cent. New vehicles manufactured in Asia experienced growth of 0.2 per cent month-over-month and 3.2 per cent year-over-year, ($32,679), while North American new vehicles registered a 0.8 per cent decrease month-over-month and a 3.4 per cent increase year-over-year, closing at $52,055.

Similar to new European vehicles, European used vehicles experienced a sizeable year-over-year increase at 14.4 per cent ($26,895) with a modest month-over-month decrease of 0.3 per cent. North American and Asian vehicle prices experienced year-over-year increases of 4.9 and 3.6 per cent, and month-over-month increases of 2.2 and 0.8 per cent, closing the month at $21,454 and $17,495 respectively.

Used vehicle prices experience regional year-over-year growth

Ontario, British Columbia and Atlantic Canada witnessed the highest month-over-month increase in new vehicle prices at 1.5 per cent ($38,558), 1 per cent ($41,200) and 0.3 per cent ($32,599) respectively. Despite seeing the most significant month-over-month pricing decline of 0.4 per cent, compared to other regions, Alberta still remains the province with the highest average price for a new vehicle at $45,815. This higher median price could be driven by above-average popularity of trucks in the region.

Used car prices increased year-over-year in all provinces, except for Manitoba and Saskatchewan where pricing remained flat ($23,577). British Columbia and Alberta witnessed the strongest year-over-year growth across all provinces at 10 and 7 per cent respectively, closing the month at $21,988 and $24,488. Québec and Atlantic Canada remain the regions with the lowest average price for used vehicles in Canada, at $16,895 and $18,495.

These were the Top 5 Most Searched vehicles during November of 2020 on autoTRADER.ca’s marketplace:

- Ford F-150 (#1)

Median price new: $54,434

Median price used: $34,995

- Ford Mustang (#2)

Median price new: $46,315

Median price used: $29,849

- BMW 3-Series (#3)

Median price new: $57,758

Median price used: $22,999

- Mercedes-Benz C-Class (#4)

Median price new: $58,995

Median price used: $31,888

- Porsche 911 (#5)

Median price new: $165,035

Median price used: $117,045

- Honda Civic (#6)

Median price new: $30,400

Median price used: $9,995

- BMW M (#7)

Median price new: $106,114

Median price used: $62,988

- Toyota RAV4 (10)

Median price new: $35,8457

Median price used: $23,900

- Mercedes-Benz E-Class (#9)

Median price new: $86,000

Median price used: $34,173

- Chevrolet Corvette (#8)

Median price new: $97,380

Median price used: $60,000

Released monthly, the autoTRADER.ca Price Index provides a snapshot of the Canadian automotive market to bring a level of transparency to the vehicle buying process. Analyzing pricing data from autoTRADER.ca’s marketplace of over 450,000 listings, tracking new and used vehicle pricing allows our data experts to identify how prices are trending nationally and provincially, along with the most searched models by consumers.