Researching and buying a new car can be an intensive process that involves a lengthy slog through new terminologies, options, add-ons, and abbreviations. While researching car insurance, shoppers will also encounter a selection of new terms and language they might not be familiar with. Understanding these is vital to making the right purchase decision regarding your car’s insurance.

I’ve compiled 14 of the most popular questions Canadians are asking about car insurance and asked a panel of experts to help answer each. We’ll hear from Aren Mirzaian, CEO of MyChoice, Grant Clarke, VP of National Personal Insurance at BrokerLink, and Odel Laing, the Agency Manager at Allstate Barrie.

What Happens in an At-Fault Accident?

In an at-fault accident, you’re deemed to be at fault.

Maybe your vehicle skids off of the road after encountering some black ice. This would likely be deemed an at-fault accident, as the driver is responsible for the vehicle and driving according to conditions. Getting hit by a car as you come out of your driveway is likely an at-fault accident, too.

But one of the most common types of at-fault accidents is rear-ending another vehicle.

“If Driver A hits Driver B while Driver B is legally parked, then Driver A is likely at fault,” says Allstate’s Laing. “We say ‘likely’ because there can be some nuances.”

What Happens in a Not-at-Fault Accident?

Some of the most common types of not-at-fault accidents include being struck by another driver while you’re parked or stopped at a stop sign. Impacts with wildlife are not-at-fault unless the driver goes off the road or hits another vehicle while trying to miss the animal in question, in which case the accident becomes an at-fault.

As Laing mentioned, there can always be nuances.

What Are Some Examples of an At-Fault Accident?

“Whether it’s a simple fender bender or a serious collision, insurers have a process to determine who’s at fault, regardless of how much damage there is to the vehicles involved,” explains Grant Clarke, Vice President, National Personal Insurance, BrokerLink.

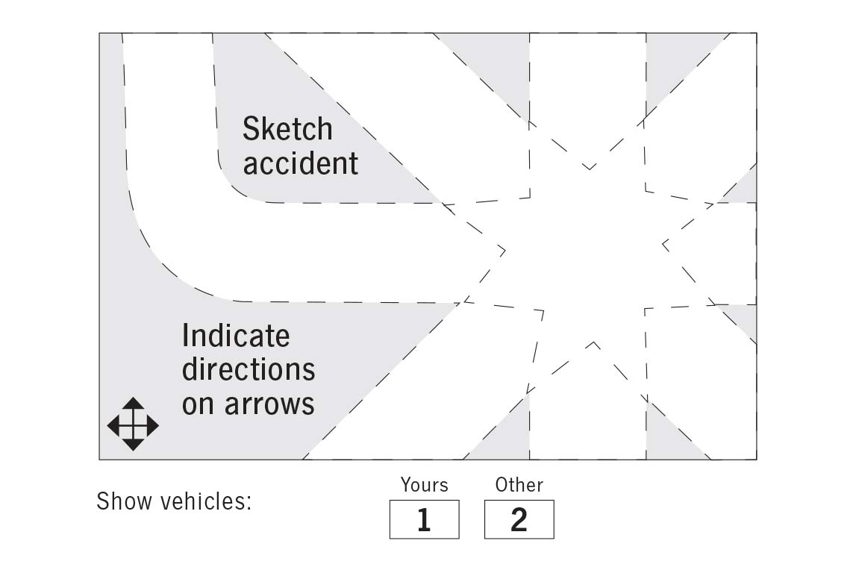

To assess each driver’s degree of responsibility, insurers use a set of established provincial rules called Fault Determination Rules, which illustrate the most common accident scenarios.

For example, the driver ahead of you suddenly slams on their brakes, causing you to rear-end them. According to most provincial rules, you are 100 per cent at fault because the Highway Safety Code stipulates that each driver must keep a safe distance between them and the vehicle ahead. In another example, you and another driver back into one another in a mall parking lot, resulting in damage to both vehicles. In this case, you are both at fault. The degree of each driver’s responsibility is determined based on the province’s Fault Determination Rules. Each driver will be covered by their own insurer for damage to their vehicle, based on their responsibility and the coverages they purchased.

Can I Be Found Partially at Fault in an Accident?

Yes, you can indeed be partially at fault in a collision. In fact, a complex set of guidelines is used by experts to help determine how much fault is placed on each party in a collision.

“Fault determination rules are used by all insurance companies,” explains Laing. “These are specific guidelines that determine how fault is allocated. They look at percentages, measurements, reports, and other information. The fault determination rules are publicly available, but ultimately interpreted by claims adjusters to assign fault in an accident.

“In an accident involving numerous vehicles, the fault is apportioned accordingly between all drivers.”

“Even situations that are beyond your control are subject to the province’s Fault Determination Rules,” adds Clarke. “For example, your car sliding on an unexpected ice patch and then hitting something.”

Can You Fight an At-Fault Accident or the Way Fault Was Assigned?

According to MyChoice’s Mirzaian, that’s a negative.

“Insurance companies utilize fault determination rules to precisely allocate fault in various situations,” Mirzaian explains. “These determinations are highly unlikely to be reversed or overturned.”

What Is No-Fault Insurance and How Does It Work?

In 1990, no-fault insurance was introduced to prevent delays and disputes between lawyers and insurance companies. Even if a third party caused the collision, your insurance company will still take care of repairing your vehicle and covering your accident benefits. The idea of no-fault insurance is to prevent policyholders from spending time and money on hospital costs and vehicle repairs while dealing with another party’s insurance company.

“It’s a categorization of insurance,” explains Laing. “No-fault means each individual involved will go to their own insurance to address their claim, whether or not they’re at fault.”

No-fault insurance is the norm in some provinces, but in others, the Tort system still applies.

“In a Tort situation, the driver and occupants may need to go after the at-fault party’s insurance through the court system for compensation,” Laing says. “But with no-fault insurance, you deal with your own insurance. This leads to lower premiums across the board.”

Which Provinces Have No-Fault insurance?

No-fault insurance is available in Ontario, Quebec, British Columbia, Nova Scotia, PEI, and New Brunswick.

What Does No-Fault Insurance Cover?

According to BrokerLink’s Clarke, there are several examples of no-fault insurance coverages that apply to different situations:

“With accident benefits coverage, the vehicle owner’s insurance company pays for items covered under accident benefits, such as medical expenses like prescription medications and rehabilitation, for the driver and occupants of the borrowed car.

“Direct compensation-property damage coverage sees the vehicle owner’s insurance provider paying out repair costs for the damaged car, regardless of which driver is at fault – and depending on the circumstances of the collision.

“With uninsured automobile coverage, If the incidental driver and the borrowed car are victims of a hit-and-run or get into an accident with an uninsured or underinsured driver, the vehicle owner’s uninsured automobile coverage will help cover the costs.

“With third-party liability coverage, if the incidental driver caused the accident, they could be sued by the victim. In such an instance, the vehicle owner’s insurance company must pay the liability costs (defence costs, court fees, settlement costs, etc.). Otherwise, the other party’s insurance pays.

“Collision coverage is an optional type of coverage that comes into play if the accident claim does not occur through the direct compensation-property damage portion of your policy. In such an instance, the vehicle owner’s insurer pays the repair costs. These costs are subject to the coverage limits established in the vehicle owner’s auto insurance policy.

“It’s important to note that if the accident is a result of the insured driver breaking the law, coverage may not apply, depending on the policy terms.”

Does an At-Fault Accident Affect Insurance Rates?

“Any collision goes on your driving record, and several components affect your rates,” explains Laing. “The type of vehicle you drive, your driver history, and your commute length are some examples. Once a driver is in an at-fault accident, they’ll likely see an increase in premiums – but again, accidents aren’t the only thing that affects your rates.”

Does a Not-At-Fault Accident Affect Insurance Rates?

“It is likely that rates will not go up due to a not-at-fault accident,” says Laing. “Again, specific results may vary since insurance is highly personalized, and your rates are affected by many factors.”

What if I Have Claims Forgiveness?

Claims forgiveness deals with at-fault accidents. Generally, your first at-fault accident under this type of policy will cost you your accident-free status, though a not-at-fault accident will not.

What Is a Moving Violation?

“A moving violation is any violation of the law committed by the driver of a vehicle in motion,” explains Clarke. “Moving violations are charged against the actual driver, not the owner of the vehicle. Examples include failure to use a seat belt and speeding, and texting while driving. Moving violations don’t necessarily cause accidents (e.g. lack of seat belt), however, they may contribute to the severity of accidents.”

“An at-fault accident and a moving violation are separate incidents, but they can intersect if you were involved in an at-fault accident due to a moving violation,” Mirzaian adds. “For instance, if you ran a stop sign and caused an accident, running the stop sign would lead to a conviction classified as a moving violation. Simultaneously, the accident you caused would be considered an at-fault accident.”

How Long Does an At-Fault Accident Stay on Your Record?

“Accidents deemed at fault are subject to a six-year rating period, impacting both your insurance premium and eligibility with insurance companies during this time,” Mirzaian explains.

“Nevertheless, certain accidents can be ratable for up to 20 years, depending on the specific insurance company you are obtaining quotes from. Most companies typically categorize a flawless driving record after nine years of incident-free driving. However, some insurers offer preferred rates to individuals with 10, 15, and even 20 years of accident-free driving history.”

What Happens if I Have a Not-At-Fault Accident in a Rental Car?

“In some cases, your auto policy may extend accident benefits and third-party liability coverage to a rental car,” explains Clarke. “Physical damage to the rental vehicle may also be covered if you have the same coverage on your current auto policy. Before you rent a vehicle, check with your insurance broker or insurance company to find out what your coverage includes.”