If you’re considering an electric car or a hybrid, you may be wondering if it costs more or less to insure compared to a regular vehicle; and whether there are any insurance benefits or disadvantages to going green. We were curious too, so we asked some of Canada’s major private and public insurance agencies how they determine insurance rates for EVs and hybrids.

Many vehicles, one formula

We were somewhat surprised to learn that most vehicle insurance agencies in Canada, both private and public, begin with the same vehicle-loss cost evaluation system. It’s called the Canadian Loss Experience Automobile Rating (CLEAR) system from the Insurance Bureau of Canada. Using a database of insurance claims from across the country, CLEAR is used to assess how likely a specific vehicle will be involved in a claim and what that claim will likely cost. Every model of car and light truck for every model year is grouped according to the assessed risk of its expected claims frequency and cost, and likelihood that it will be stolen.

“CLEAR is used by most insurance companies to ensure accurate and credible rating based on actual claims loss experience for all vehicles, including electric vehicles and hybrids,” explains Sephora Sciara, Assistant Vice-President of Insurance Administration with CAA Insurance.

Then there are the other factors particular to you and your life: where you live and drive, your age and gender, your driving record and claims history, who drives the car, what the car is used for and how far it is driven, the car’s safety features, and in some provinces, your graduated licence level (e.g. G1, G2, G ).

Insurance rates for any car can vary from one postal code to the next, says John Bordignon, Media Relations spokesperson for Desjardins Insurance. “There are distinct differences in where a driver from Toronto lives within the city. It is based on postal codes, so someone that lives in the east end of the city (Scarborough) will pay a different rate for the same car and driving record as someone who lives in the west end (Etobicoke). Insurers look at things like the history of theft, collisions, repair costs, traffic severity, property damage, etc. that have occurred historically in a specific postal area.”

Higher MSRP and advanced tech raise the baseline

But there are a few factors that affect EVs and hybrids in particular. As these vehicles are typically more expensive than traditional vehicles of a similar size, their insurance claims can be higher – leading to higher premiums, says Stephanie Beland, Director of Communication at Industrial Alliance Auto and Home Insurance in Quebec. “For some models, the cost (MSRP) of the electric/hybrid version can be significantly higher than with a traditional powertrain, which can lead to more severe claims in case of total losses.”

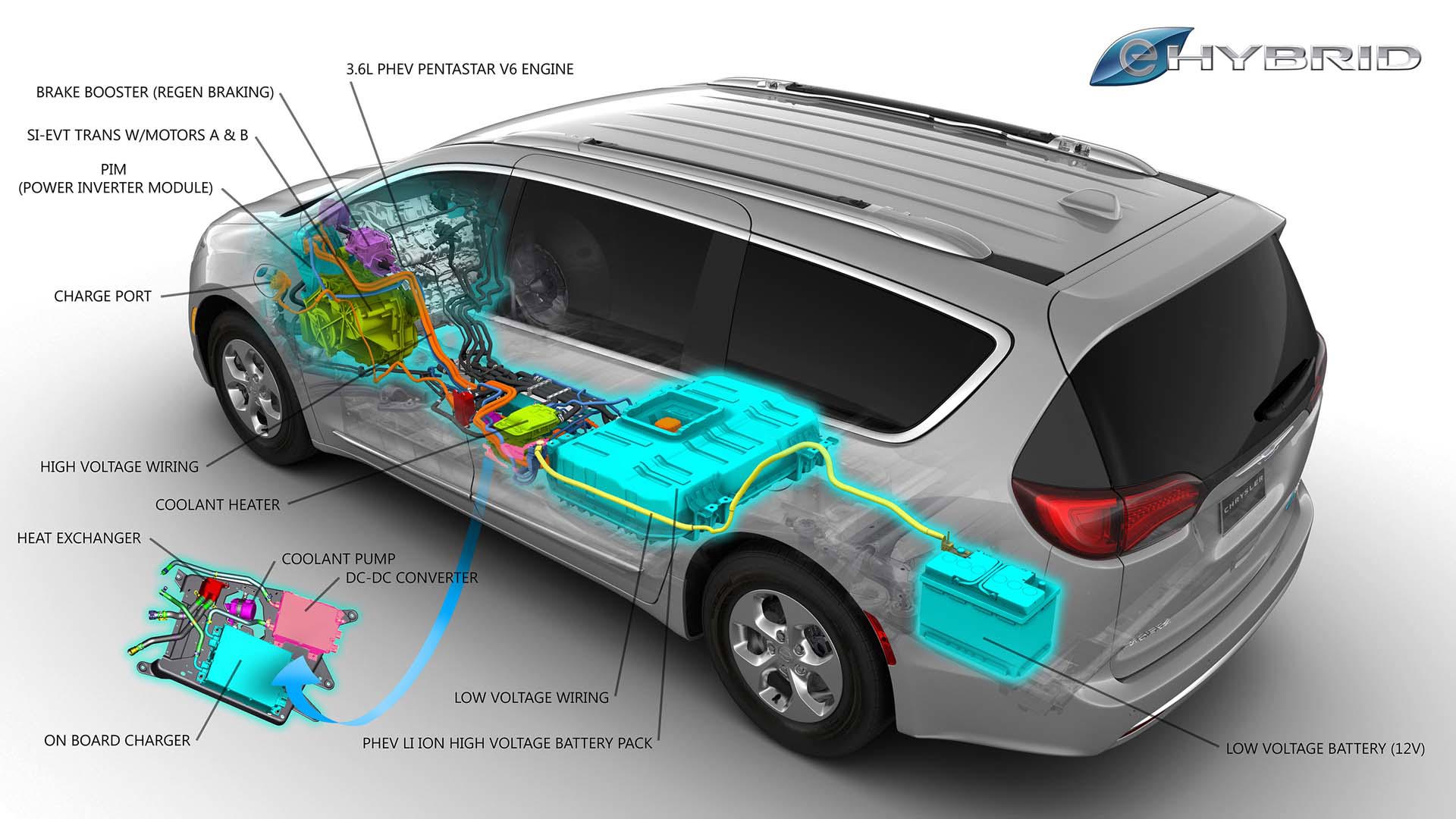

As well, Beland notes that some parts of EV and hybrid vehicles are more expensive to replace or repair than parts for traditional cars. “The batteries can be expensive to replace,” she notes. “However, the position of the battery in the vehicle is a factor in its potential to be damaged. One question we have to ask to ourselves is: where is the battery located on the vehicle, will a collision result in a battery replacement? For some models, yes; while for other models, the battery is in a less-vulnerable place.”

Crystal Jongeward, Manager of Corporate and Public Affairs, TD Bank Group, agrees. “While the batteries may be expensive, repair costs really depend on the area of the car where the damage occurred and the level of damage,” she says.

Bordignon says that the cost to repair/replace a vehicle does factor into calculating its insurance rates. “EV/ hybrid vehicles have newer technology and may be more technically complex – in some cases, they may cost more to repair/replace. However, all vehicles (hybrid/EV/gas-powered) are rated based on their own individual claims cost,” he notes.

Manitoba Public Insurance Media Relations Coordinator, Brian Smiley, says that repair costs and parts replacement of all vehicle types factor into MPI’s rate-setting process. “Newer vehicles equipped with driver assist safety features can be expensive to repair, compared to an older-model vehicle with no such features. Rising repair/replacement costs can/will affect future driver premiums.”

The type of motor under the hood is also a factor in determining insurance rates, says Steve Kee Director, Media and Digital Communications of the Insurance Bureau of Canada. “With a hybrid vehicle, the insurance company must evaluate the value of the vehicle and how to insure it based on the kind of engine that it has. Hybrids vary enough to make the insurance company ask what type of engine they are insuring.”

Discounts driven by incentives, lower claim frequency

Balancing out the negatives are some positive factors that affect insurance rates for EVs and hybrids. “Results have shown us that drivers of EVs and hybrids vehicles will usually have a smaller claim frequency,” says Beland. “We don’t offer a specific uniform discount (for EVs and hybrids), but we have reduced rates for the vehicles for which we expect fewer claim amounts. For example, that’s the case for the Toyota Camry Hybrid.”

“Though total loss claims for EVs can be more severe, it needs to be balanced against a smaller claim frequency for EVs and hybrids,” says Beland. “In these cases of an increased cost, it really comes down to determine if the reduction in claim frequency offsets the increase in severity. For some models, it does and we warrant a discount, while for others model, it does not.”

Another factor in EV/hybrids’ favour is the relatively small number of EVs and hybrids on the road in Canada. That makes it difficult to establish collision costs, says Kee. “While CLEAR’s goal is to achieve a stable system of rate groups that credibly reflect actual claim experience, a sufficient amount of specific vehicle experience is not always available, especially for newer vehicles. As for underwriting costs to repair – we don’t have data on trends as there are not that many on the road.”

Bordignon concurs: “Although EV/hybrid vehicles are becoming more popular, they are still only a fraction of the total number of vehicles in Canada. It’s still early to speculate how insurance rates will change for EV/hybrids; however, monitoring the costs of repairs, frequency of theft, and collision data is something insurance providers look at closely.”

Still, some insurance companies are offering reduced rates as a way of encouraging drivers to drive more environmentally friendly vehicles. TD Insurance, Desjardins Insurance, Intact Insurance, and CAA Insurance are all offering insurance discounts for EVs and hybrids.

TD Insurance is currently offering EV and hybrid owners a five-percent “Green Car Discount. “TD Insurance is committed to making a positive impact on the environment and to supporting the transition to a low-carbon economy,” says Jongeward.

Desjardins Insurance is also supporting green initiatives across Canada. “Our property and casualty insurance products also offer premium discounts for environmentally conscious members and clients,” says Bordignon.

For now, it appears that the main reason that insurance rates for EVs and hybrids are higher than traditional cars of a similar size and equipment level is that EVs and hybrids have higher MSRPs. But as more EVs and hybrids hit the streets and more claims data is available to insurers, rates could go higher as the result of more expensive collision claims; or perhaps remain steady due to fewer claims by EV and hybrid drivers.

“The principle of insurance is to charge a rate that is proportional to the risk of claim,” says Beland. “As we gain more and more data on electric and hybrid vehicles claims, the more precise and fair rates will be. It is still early to have a definitive answer on the subject.”